Seattle 9:23 pm

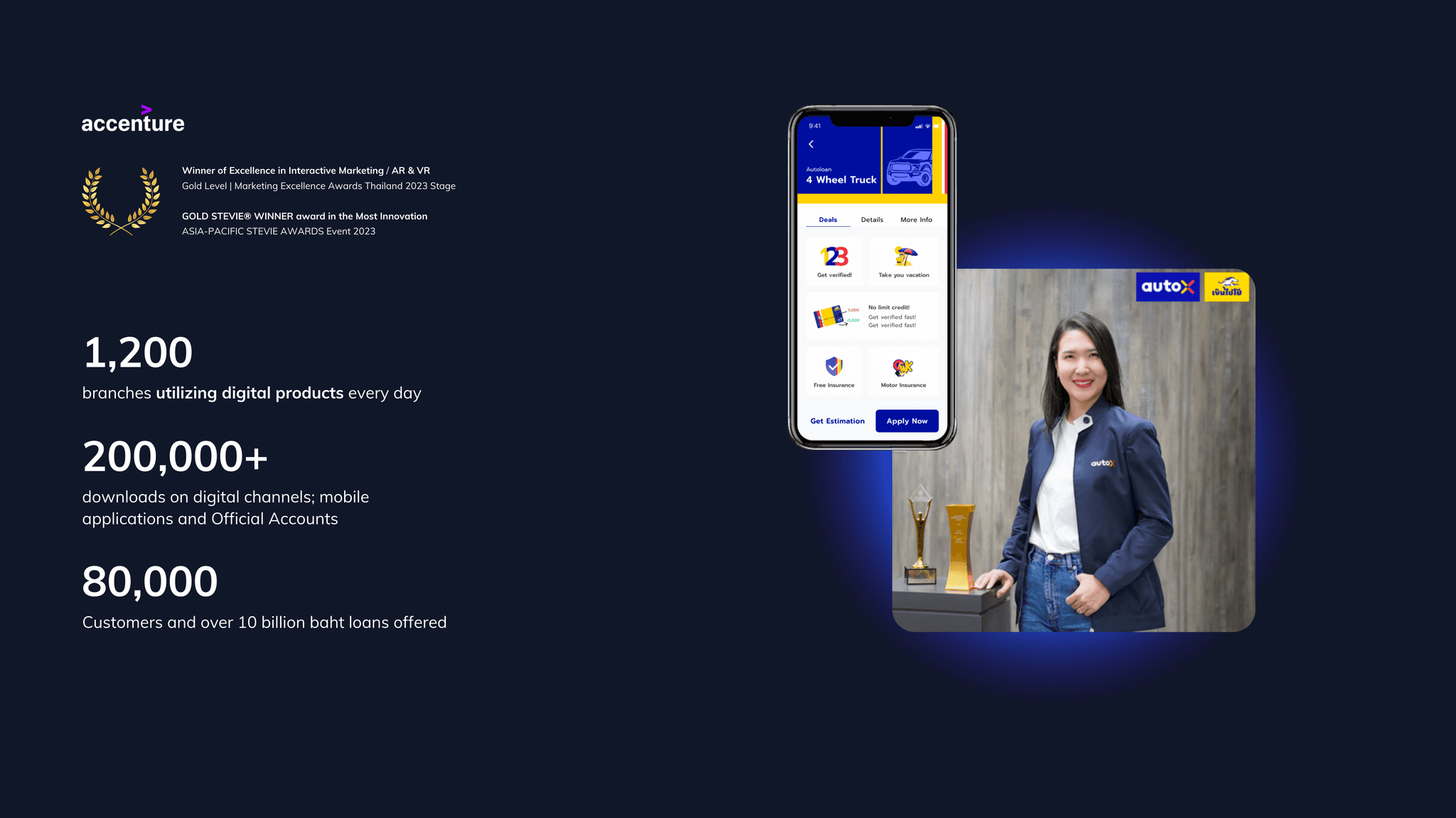

[ CHALLENGE ]

The lack of digital infrastructure to process loans virtually was hindering people from accessing the financial services they desperately needed.

Customers have to visit the branch to inquire / onboard loan

Unable to digitize financial documents remotely

In-person vehicle inspections ceased operation

Loans for low-income citizens unavailable during the pandemic

[ SOLUTION ]

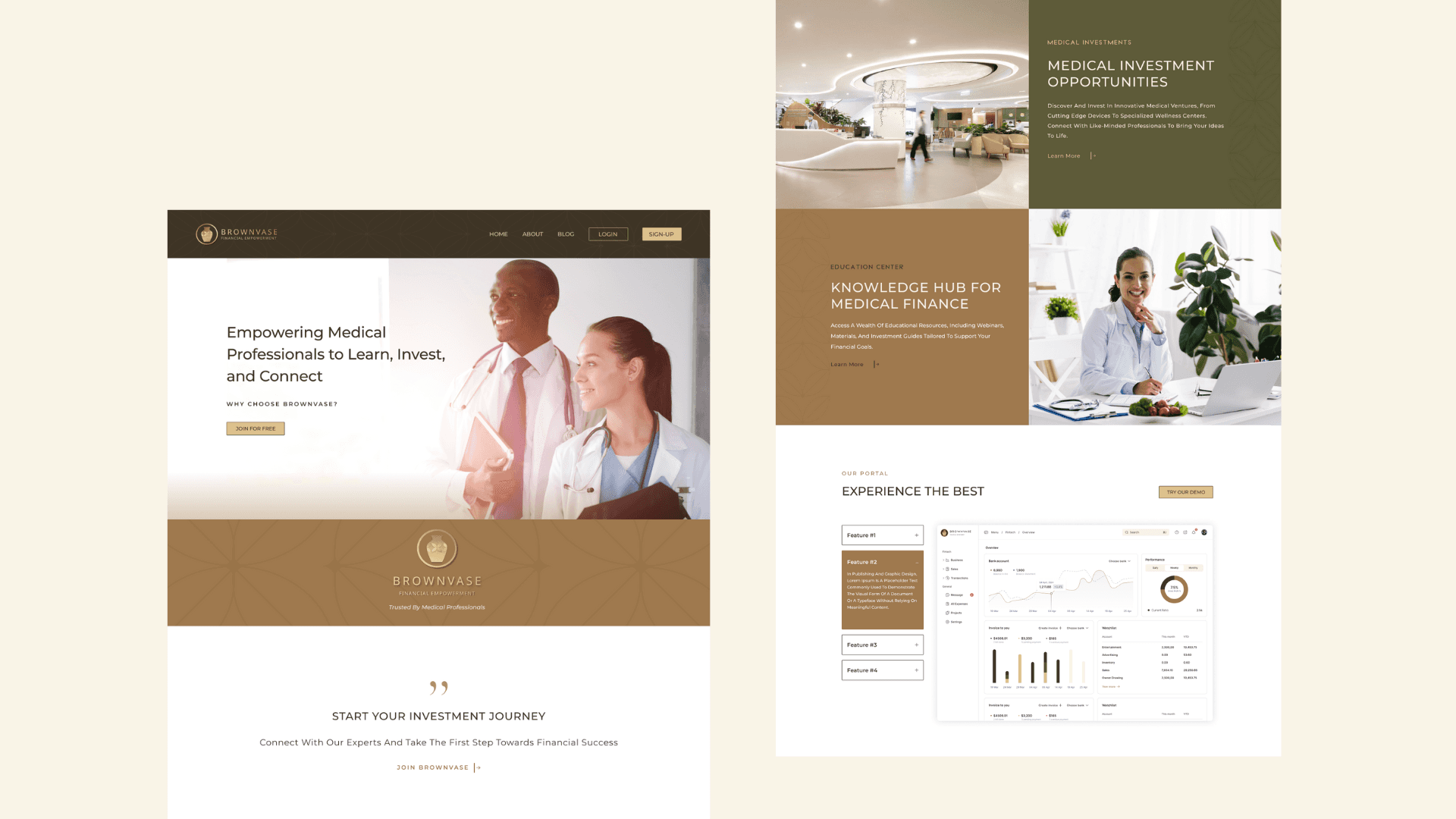

Fully digitize the title-loan process by creating a new virtual platform where customers can seamlessly operate their loan process from start to end through our mobile application.

Features:

Browse loans

Get loan estimates

Upload financial documents remotely to get pre-approved / onboard application

Virtual vehicle inspection via AR

Seamlessly track & pay loans through app / LINE OA

[ TESTIMONIAL ]

Patrick Lopez

Lead Product Designer @ Photon